The inquiry found that commercial loans — worth billions of euro — were handed out during the boom years without basic checks, like proper valuations or personal guarantees.

The Central Bank has concluded one of the longest-running and most complex inquiries it’s ever undertaken.

Spanning 15 years and costing more than 24 million euro, the investigation examined the practices of senior executives at Irish Nationwide, which led to its collapse during the financial crash.

More than 40 regulatory breaches at Irish Nationwide have been laid bare in the Central Bank’s final report into the lender.

The inquiry found that commercial loans — worth billions of euro — were handed out during the boom years without basic checks, like proper valuations or personal guarantees.

In one board meeting alone, 38 loans worth over half a billion euro were approved.

The regulator says these systematic failures played a major role in the bank’s collapse — which ultimately cost taxpayers 5.4 billion euro.

Today, former finance director John Purcell has been sanctioned for his part, with a recommended fine of 130-thousand euro and a four-year disqualification — pending High Court approval.

Mr Purcell is not appealing the outcome.

The Central Bank says the move is a key step in holding senior figures accountable.

Local Property Tax Deadline Extended To Wednesday

Local Property Tax Deadline Extended To Wednesday

Lawless Rejects Claim He Let Apprenticeship Exam Leak Scandal "Fester"

Lawless Rejects Claim He Let Apprenticeship Exam Leak Scandal "Fester"

Three Teenagers Arrested In Connection With Rioting At Citywest Hotel Last Month

Three Teenagers Arrested In Connection With Rioting At Citywest Hotel Last Month

Alleged Admissions Row Ignites Between Leixlip Schools Over Irish V English Language Pathways

Alleged Admissions Row Ignites Between Leixlip Schools Over Irish V English Language Pathways

BreastCheck To Fall Short Of Screening Target For Third Year Running

BreastCheck To Fall Short Of Screening Target For Third Year Running

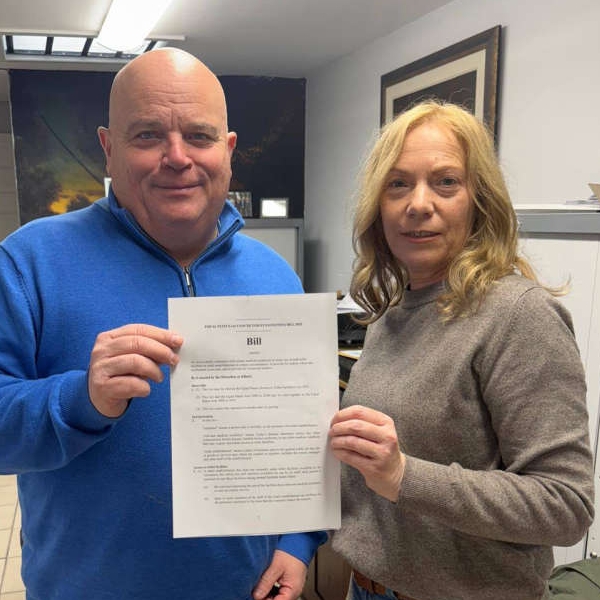

Kildare Woman Forced To Urinate In Car Park As TD Pushes Law For ‘No Wait’ Toilet Access

Kildare Woman Forced To Urinate In Car Park As TD Pushes Law For ‘No Wait’ Toilet Access

Dublin Jersey Among Tributes To Ryan Weir Gibbons - Death “Unnecessary And Tragic” Says Priest

Dublin Jersey Among Tributes To Ryan Weir Gibbons - Death “Unnecessary And Tragic” Says Priest

Three Decades Later, Search For Answers In Jo Jo Dullard Case Continues

Three Decades Later, Search For Answers In Jo Jo Dullard Case Continues