In Kildare, farmer Martin Byrne from Kilberry, Athy, under-declared income tax, resulting in a settlement with revenue of €526,784.

According to the latest quarterly tax defaulters’ list released by Revenue, settlements with 16 tax defaulters in the last three months of 2023 amounted to over €5 million, with four settlements surpassing €500,000.

In Kildare, farmer Martin Byrne from Kilberry, Athy, under-declared income tax, resulting in a settlement with revenue of €526,784.

Portersize Transport Services Limited, operating in Timolin, Moone, made a settlement of €252,849 for under-declaration of Corporation Tax, PAYE/PRSI/USC, and VAT.

While Power Food Technology Limited, situated in Clane Business Park, faced a settlement of €160,171 for under-declaration of Corporation Tax and PAYE/PRSI/USC.

Transmedix Limited, a medical staff provider headquartered in Carrigaline, Cork, reached the highest settlement of the quarter, totalling €586,600. This sum includes taxes, interest, and penalties for non-declaration of corporation tax and PAYE/PRSI/USC.

Ina’s Kitchen Desserts, operating under the name Broderick’s, settled for €535,069. The manufacturer, based in Tallaght, Dublin, faced a Revenue audit which revealed under-declarations of corporation tax, PAYE/PRSI/USC, and VAT.

Brian Carthy, GAA commentator and author, known professionally as a “journalist trading as Sliabh Ban Productions," settled for €129,759 following an audit which revealed under-declarations in income tax, PAYE/PRSI/USC, and VAT.

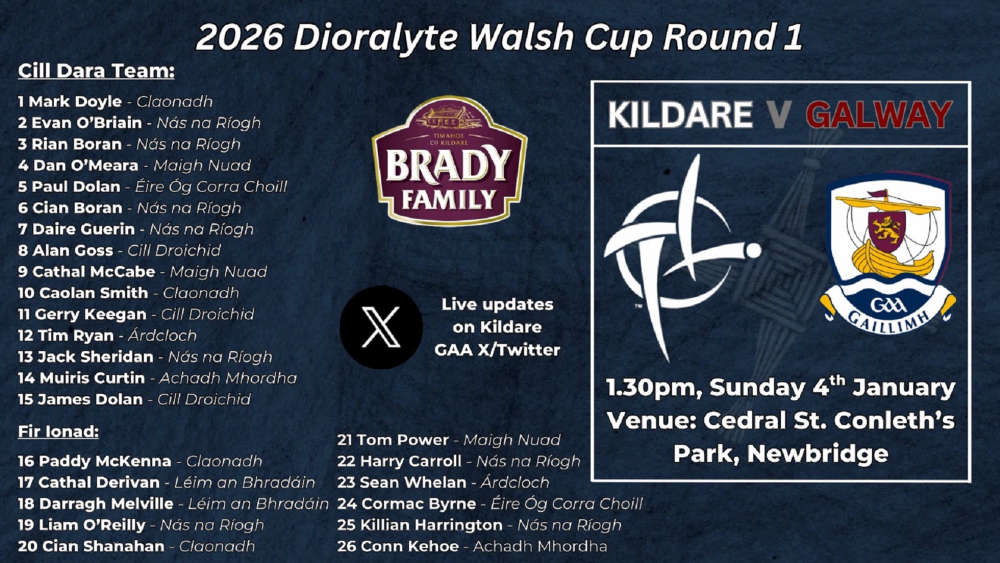

Kildare Senior Hurling Team vs Galway

Kildare Senior Hurling Team vs Galway

Missing Naas Woman Deborah Doyle Located "Safe And Well"

Missing Naas Woman Deborah Doyle Located "Safe And Well"

Kildare SF Team (one late change) vs Wexford

Kildare SF Team (one late change) vs Wexford

Average Price Of Three-Bed Semi-Detached Homes In Kildare Now Cost €400,000

Average Price Of Three-Bed Semi-Detached Homes In Kildare Now Cost €400,000

Council Says Reopening Celbridge Abbey Car Park Would Hit Parking Budget

Council Says Reopening Celbridge Abbey Car Park Would Hit Parking Budget

Where To Recycle Your Christmas Tree In Kildare From Next Week

Where To Recycle Your Christmas Tree In Kildare From Next Week

Over 9,000 Tusla Referrals Linked To Poor School Attendance Were Made Last Year

Over 9,000 Tusla Referrals Linked To Poor School Attendance Were Made Last Year

Homelessness Figures Reach Another Record High, With Numbers Also Increasing In Kildare

Homelessness Figures Reach Another Record High, With Numbers Also Increasing In Kildare